Nov 8, 2014 What you will learn from reading Chapter 6 of “Why Stocks Go Up and Down”

Chapter 6 – Earnings Dilution – JMC Goes Public

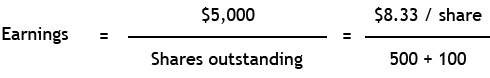

Chapter 6 looks at the stock dilution that results from a new stock offering. A step by step numerical example is presented so this important concept is clearly understood. The impact of possible dilution is always considered by investors when valuing a stock.

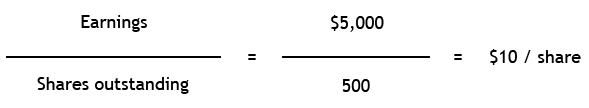

Dilution occurs when a company issues new shares of stock, which makes each of the pre-existing shares worth less, because each share now represents a smaller portion of ownership of the company. Let’s look at a simple example: JMC is earning $5,000 per year and has 500 shares of stock outstanding. Thus it has Earnings Per Share (E.P.S.) of $10, as shown below.

Dilution also arises in other ways. Companies will experience dilution when they : 1) issue convertible bonds (see Chapter 11), 2) issue convertible preferred stock (see Chapter 13), 3) give employees stock options as part of an incentive plan, and 4) issue Warrants or Rights. (We do not cover Warrants and Rights in the book, but they are in effect like stock options, in that they may be converted into shares of stock at some future time.

In Chapter 6 we go through the step by step dilution calculation twice, using different assumptions about the price of the stock. We see that the company suffers much less dilution if they can sell the stock at a higher price. This is one reason why companies like to keep their stock price high, to minimze dilution if they are doing a stock offering.

Potential dilution is an important consideration in stock prices, and readers are encouraged to follow the example on pages 78-82 of the book closely.

In this chapter we also look at stock splits and stock dividends. Although stock splits and dividends do result in more shares outstanding and a lower price for the stock, they are not considered to be dilutive. This is because all stock holders at the time of the stock split or stock dividend get new shares to keep their ownership percentage at what it was before the split or stock dividend.

Like Chapter 5, we believe Chapter 6 may be unique among investment books. We have not seen another book that is careful to explain dilution so completely.

Excerpts and comments about other chapters will be posted. If you want a preview of what is covered in the book immediately, or if you want to learn more about investment education, please visit our website at www.whystocksgoupanddown.com and click on Contents or Blog.

No Comments