Nov 9, 2014 What you will learn from reading Chapter 7 of “Why Stocks Go Up and Down”

Chapter 7 – Financing Growth: Selling New Stock Versus Selling New Bonds

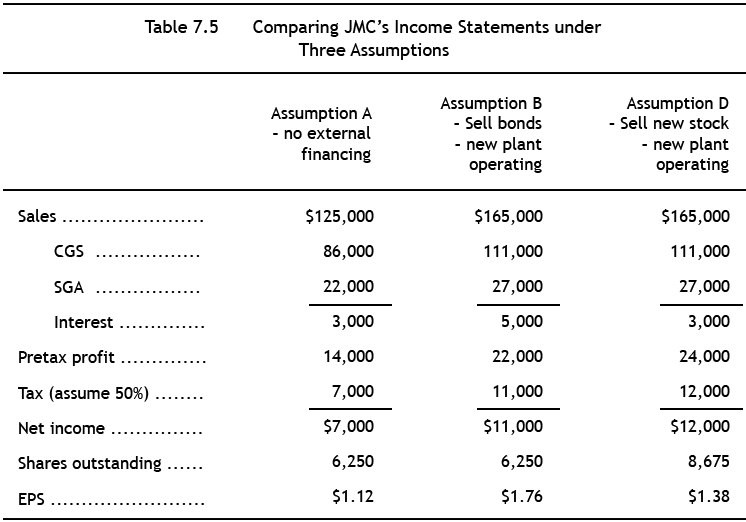

Part of a good investment education is learning to think like management. In Chapter 7, JMC wants to finance (raise money for) a new manufacturing plant. The company must decide between issuing more stock (an equity financing) or issuing bonds (a debt financing). To make this decision, management first makes a forecast of the sales and profit that the new plant is expected to generate when it is fully up and running, and then projects what the income statement would look like if the new plant was financed with new stock, and if the new plant was financed with debt (selling bonds.) Table 7.5, taken from page 102, shows the result of these forecasts. The assumptions behind these forecasts are in the chapter. It is evident from Table 7.5 that financing with new debt will produce higher earnings per share in the future than financing by selling new stock. Other things being equal, that will produce the highest stock price and be best for the stockholders (the owners of the company).

My class lectures about Chapters 5, 6, and 7 often seemed to be a breakthrough point for students in understanding stocks and investing. Many such comments were received, but one that stands out was the student who said, “I’m not sure what my questions were, but over the last few classes, they just went away.” This comment always reminds me of the importance of a thorough grounding, and teaching, of the fundamentals.

Excerpts and comments on other chapters will be posted. If you want a preview of what is covered in the whole book immediately, please visit our website at www.whystocksgoupanddown.com and click on Contents.

For more information on investment education, please visit our website at www.whystocksgoupanddown.com and click on Blog.

No Comments